Deciding Between a Traditional and a Roth 401(k)

by Drew Overton | September 25, 2020 | Financial Planning, Retirement Planning

Most people have one of two feelings when asked about saving for retirement. The first is usually the feeling of being overwhelmed – thinking there are too many deferment options, too many funds to choose from, and that they have no idea where to begin. While I cannot deny the sometimes-overwhelming complexity of some retirement plans, the decisions you make regarding your individual retirement saving strategies can be simplified and, most times, easily implemented. The second feeling is typically more care-free, stating that retirement is way down the road, and that they would rather not worry about it. Regardless of your response to this question, beginning to save for retirement is something that you do not want to delay thanks to two important words: compounding growth. Even deciding to regularly contribute an amount that may seem small or insignificant to you, if allowed time to compound, has the potential to grow more than if you were to start at a later age.

Although there are many options to consider, one of the first decisions to make when saving for retirement is which type of deferral you would like to make. Most companies that offer traditional 401(k) plans are beginning to also include Roth 401(k) options as well. This blog is meant to provide the similarities and differences between the two and help highlight key areas to consider when deciding which may be best for you.

Before jumping into the main differences between traditional and Roth 401(k)s, it is important to first understand their commonalities. As an ERISA (Employee Retirement Income Security Act) qualified plan, 401(k) plans have certain rules and requirements for both employers and employees. In order to stay concise, we will focus solely on the important aspects of 401(k) plans as it pertains to employees, not employers.

General rules for 401(k) plans

401(k) plans have contribution limits. For 2020, an employee may contribute up to $19,500, and an additional $6,500 as a “catch-up” contribution, if 50 years old or older. Please note that this is an aggregate limitation, meaning if you decided to contribute to both a traditional and a Roth 401(k) (which we will touch on later), your total contributions to both cannot exceed the $19,500 limit (or $26,000 if 50 years or older). Unlike IRAs, 401(k) plans have no income limitations on who can open and/or contribute to the plans, allowing a wider range of individuals to participate.

Another similarity between the two qualified plans revolves around penalties for withdrawing funds early. The general rule is that funds within your 401(k) plan may not be accessed until after reaching age 59 ½, unless you meet one of the other exceptions such as death, disability, $5,000 for birth or adoption expenses (new), etc. The consequence for tapping into your retirement funds without satisfying one of the exceptions is a 10% penalty on the amount withdrawn. Also note that with the novel coronavirus, lawmakers have introduced temporary exceptions to some of these rules if negatively impacted by the virus. However, before making any decisions, please meet with your company’s plan sponsor to discuss what options are available to you.

Lastly, both traditional and Roth 401(k)s are subject to required minimum distributions (RMDs). During a “normal” year (without coronavirus-related relief), an individual who has reached required minimum distribution age (72 as of January 2020), must annually distribute a certain calculated amount from their qualified retirement accounts.

This is not an exhaustive list, but rather a condensed view of the main similarities of both the traditional and Roth 401(k)s. Next, we will explain the main differences, and how you may benefit from contributing to one over the other.

The main difference between traditional and Roth 401(k)s

The main difference between traditional and Roth 401(k)s is when you pay the tax. For traditional 401(k) plans, your contribution is pre-tax, meaning you are not taxed on the amount deferred from your paycheck. While the funds are invested within the retirement account, assets grow tax-deferred until distribution. Then at retirement, qualified distributions from retirement accounts are fully taxable. The illustration below shows the tax-treatment of traditional 401(k)s.

Quick note on the term tax-deferred: If you have a brokerage account and own stock within the account (non-retirement assets), it is considered a taxable (not tax-deferred) account. Meaning, if you were to sell shares of stock in the account, you would be taxed on the proceeds attributable to the growth (fair market value minus cost basis). Conversely, retirement accounts provide tax-deferred growth, allowing transactions to avoid taxation within the account. This can be very beneficial, especially for more active investors.

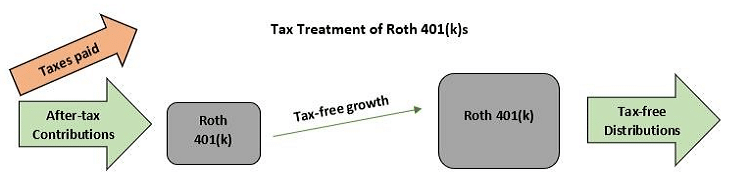

Roth 401(k)s, as you might have guessed, reverse the tax treatment. Contributions are after-tax so the funds both grow and are distributed tax-free. The big difference here is that you are forced to pay taxes on your contributions. This makes it important to review your withholdings throughout the year to avoid a major tax bill due the following April. The figure below shows how funds are taxed, how they grow, and how distributions are treated when utilizing a Roth 401(k) plan.

A unique requirement for Roth 401(k)s, called the 5-year rule, requires five years from the date of the initial contribution to pass before any qualified distributions can be made. Also remember that in addition to this rule, Roth 401(k)s are still subject to early withdrawal penalties. The 5-year rule applies to both Roth 401(k)s and Roth IRAs. An important thing to note when rolling your Roth 401(k) into a Roth IRA is that the five-year clock is separate for both accounts. Specifically, if you have had (and contributed to) your Roth 401(k) for over 5 years, but recently opened a Roth IRA to receive the rollover, the five-year clock resets for the Roth IRA. Be sure to meet with a financial planner to guide you through this process, as many of these rules can be complex.

Which retirement plan is right for you?

When deciding between a traditional and a Roth 401(k), one major determining factor is the difference between your current tax bracket and your expected tax bracket in retirement. Simply put, you want to pay the tax when you are in the lowest tax bracket. If you are just starting out in your career with a relatively low salary, it may be best to contribute after-tax dollars to a Roth 401(k). Conversely, if you are nearing retirement and are in the highest-paying years of your career, it may be best to contribute pre-tax dollars to a traditional 401(k).

Another factor to consider is time. How much time will the funds have to be invested? For contributions to Roth 401(k)s, the net amount you contribute is less than the amount you would contribute to a traditional 401(k). Why? The contribution is taxable, and rather than compounding within your retirement account, a portion of those dollars are sent to Uncle Sam instead. Although it costs more to contribute to a Roth account, the more years that your post-tax funds can grow, the more likely that the value attributed to the tax-free growth will outweigh the immediate tax deduction.

If you are still having trouble choosing, evaluate your spending habits. Are you more prone to spend the tax savings you receive from contributing to a traditional 401(k)? If so, consider contributing to a Roth 401(k) to ensure those dollars are used for future savings. Or, hedge your bets and contribute to both traditional and Roth 401(k)s. This may relieve the stress from guessing future tax rates by simply paying half of the tax now and the other half later. Remember, the contribution limit is an aggregate limit, meaning you can contribute up to $19,500 ($26,000 if 50 or older) to all 401(k) accounts combined.

Summary

The table below gives a brief summary of the major similarities and differences between traditional and Roth 401(k)s. The most important thing to do is to contribute to your retirement account(s) – no matter the account type or amount. Take advantage of the early years, be consistent, and speak with a retirement financial advisor in Virginia Beach, Norfolk, and Chesapeake to discuss your specific situation.

| Features/Rules | Traditional 401(k) | Roth 401(k) |

| Tax-deductible contributions? | Yes | No |

| Growth of investments | Tax-deferred | Tax-free |

| Taxable distributions? | Yes | No |

| 5-Year rule? | No | Yes |

| Contribution limit (2020)* | $19,500 | $19,500 |

| Catch-up contribution (2020)* | $6,500 | $6,500 |

| Income limits to contribute? | No | No |

| 10% Early withdrawal penalty? | Yes | Yes |

| Required minimum distribution? | Yes | Yes |

*Contribution limits apply as an aggregate (for total contributions to both Traditional and Roth 401(k)s)