Planning Against Longevity Risk in Your 40s and 50s

by Drew Overton | July 2, 2021 | Financial Planning, Retirement Planning

For most people, when they enter the workforce, they begin putting away a percentage of their salary toward retirement which is a part of their financial planning. Some stay disciplined early by putting away a solid 15 – 20% of their income. Most others start anywhere from 1 – 5% and apply an automatic escalation feature where an additional percentage of retirement savings is added every year until reaching their desired retirement deferral percentage.

During the early years of the accumulation phase, it’s easy to set up recurring paycheck deferrals and forget about it – hence the “set it and forget it” mentality. However, how about for the retirement savers that are in their 40s and 50s?

Most of these savers have been setting aside funds for years but are unsure as to where they stand relative to their desired retirement date. For those of you in or nearing this stage of your professional career, ask yourself: When was the last time I looked at my retirement plan? Has my retirement savings goal been met? Do I need to adjust my savings rate, or am I in good shape for a timely retirement date? And perhaps the number one concern for retirement savers – addressing the question, Will I run out of money?

With anywhere from 5 to 20+ years of employment left, in most cases there is still time to assess your specific situation, make any needed deferral adjustments, and improve the outcome of your retirement plan. Let’s walk through the importance of annual check-ups as well as a few strategies to consider when saving for retirement in your 40s and 50s.

Annual Retirement Savings Check-ups

For most of us, we go to the doctor for our annual check-up as a proactive measure to monitor our health before a minor condition builds into a medical emergency. Some conditions, if caught early enough, can be treated and cured allowing for a longer, healthier life.

We make these check-ups a priority for our physical health, so why not make it a priority for our financial health? Even more so for people in the later stages of their career, it is imperative that you have a general idea of the status of your retirement savings relative to your end goal.

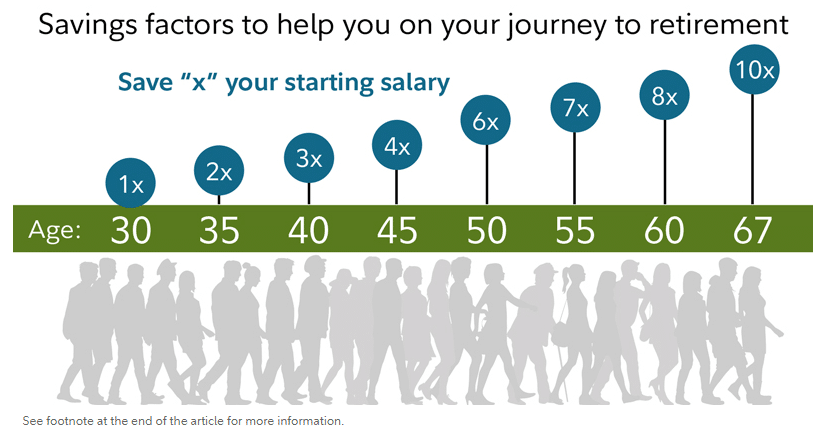

For a general gauge, Fidelity provides rules of thumb when considering the accumulation phase for savers based on your age and proximity to retirement.

As shown above, at age 40, Fidelity’s general guideline is to have at least 3x your annual salary. Twenty years later, at age 60, their general guideline is to have at least 8x your annual salary. While general in nature, this illustration drives home two very important points:

- Your retirement savings need to vastly exceed your current annual earnings to replace your income during retirement while maintaining (or slightly losing) your principal balance.

- The compound effect of early retirement dollars makes it easier for early savers to attain these retirement balances. If you have not begun saving for retirement, today is the best day to start. While more extreme savings rates may be required, starting late is better than never starting to save at all.

Again, there are a lot of different factors that go into retirement planning, and the figure above is solely meant to serve as a starting point for a righteous financial planning and retirement planning conversation. That said, let’s dive into the number one fear that people have when considering retirement.

Navigating Longevity Risk

While there are many intricacies in the world of retirement planning – estimated rate of return, expected inflation rate, future income tax bracket assumptions, etc. – it can be boiled down to the following two questions:

- How much do you plan to spend during retirement?

- How long do you plan to live?

Knowing the answers to these two questions can solidify your retirement plan. The problem? No one has yet been able to accurately predict the answer to the second question. For most people, their number one goal is not wanting to run out of money, or not wanting to be a burden on their children.

This, in financial lingo, is called longevity risk, or the risk of outliving your money. That said, what retirement planning and financial planning strategies can people in the later stages of their career implement today to further insulate their retirement portfolio against the highly feared longevity risk?

Increase Your Savings Rate

Your savings rate is a simple calculation that compares your income with how much you save, as shown below.

Savings Rate = Savings/Earnings

Each person’s ideal savings rate depends on their personal retirement plan, which calculates the total projected amount needed at retirement to fund their desired lifestyle, using certain economic and market-based assumptions.

Once this number is estimated, you then translate that into your required savings rate throughout your remaining working years. For some, this means a moderate savings rate of 10 – 15%, whereas other financial plans may require a higher savings rate to match both their desired level of spending and estimated time horizon during retirement.

Between the ages of 40 and 60, most people reach their peak earning years. They have received various promotions, have multiple years of experience in their respective fields and thus are compensated accordingly. It is important to use these years of relatively high income to boost your savings rate as your retirement date draws near.

One way to do that is to utilize the “catch-up contribution” provision. For all retirement savers, you are allowed to defer up to the lesser of your earned income or $19,500 for company retirement plans, or $6,000 for individual retirement accounts (IRAs). For retirement savers that are 50 years old or older, you may contribute an additional $6,500 into your company retirement plan as well as an additional $1,000 into your IRA, known as “catch-up contributions.”

From a tax perspective, you may be in a relatively high tax bracket as you near the end of your career. What better time to defer income taxes on the contributions to your company retirement plan than when it counts the most? After all, the value of a tax deduction is directly dependent on your current marginal tax bracket.

For example, a $7,000 deduction while in the 12% bracket is worth $840 ($7,000 x 12%), while a $7,000 deduction in the 32% bracket is worth $2,240 ($7,000 x 32%). Assuming your cash flow allows, be sure to take advantage of these catch-up contribution limits in your later years of retirement to “back-load” your retirement savings in a tax-efficient way.

Decrease Your Expenses

As you reach these high levels of income, ask yourself these questions: Can I save more? If so, how much? How will I ensure that the extra cash flow in my budget is invested for my future and not meaninglessly spent? Take some time to develop and/or adjust your budget to fit your needs.

A little time spent now can make a world of difference when it comes time for you to transition into retirement.

One way to tangibly review your budget would be to search for potential “hidden money.” Now, you may be disappointed in our definition of hidden money, but here it is: Hidden money are the dollars within your budget that are either unaccounted for and/or can be created by decreasing unnecessary spending, such as:

- Unassigned cash surplus: Let’s say that after budgeting all of your monthly expenses, you still have $150 remaining that is not tied to an expense line item. If left unassigned, this money can easily be spent on miscellaneous expenses rather than being put to work toward your retirement. Consider assigning that $150/month to retirement savings instead.

- Over-budgeted items: Additionally, you may have inflated monthly expenses in your budget. For example, do you need $800/month for dining out? Or $300/month for clothes? Or even $20/week for coffee? I am not saying you need to slash all of your enjoyable spending and eat peanut butter and jelly sandwiches until retirement, but look at your budget and scan for areas that can be adjusted. Even one less espresso latte can make a difference in your future.

- Unnecessary items: Lastly, are there line items in your budget that should not be there at all? Are you using ESPN+, Disney+, and Hulu enough to validate the monthly fee? Do you really need subscriptions to all of those magazines? Do you still need to pay for your home phone line? Take time to analyze your budget and you will most likely find places where you can redirect money to your retirement.

Engage a Financial Advisor for Your Retirement Planning

The last retirement planning strategy we want to highlight is the benefit of using a trusted financial advisor. A financial advisor can help navigate how to best utilize your remaining accumulation years via a personalized retirement plan as well as walk beside you during your transition into retirement.

If you are nearing retirement and would like to see how Tull Financial Group can help guide you through the retirement process, please give our office a call today at 757-436-1122 to schedule your free consultation meeting.