The Truth About Active Investing

by Drew Overton | May 17, 2021 | Investment Planning, Wealth Management

Volatility was a key theme for 2020, as the market was trying to predict the timeline of the economic recovery while simultaneously reacting to short-term headlines. The stock market price fluctuations presented lots of opportunities for investors with cash on the sidelines.

In addition, new trading platforms such as Robinhood decreased the barrier to entry into the market by allowing $0 trading fees, no account balance minimums, partial share purchases, and an intuitive trading program. The combination of economic shutdowns, recovery rebates (stimulus checks), and easy-to-use trading platforms paved the way for new investors to enter the market.

While last year’s market recovery made it easier for investors to make money, for today’s financial planning services blog we will focus on the inefficiencies of active trading and how taxes can eat into your total returns.

Passive vs. Active Investing

Before we discuss the impact that taxes have on active investing, let’s discuss the difference between active and passive investing. Passive investing is sometimes called the buy-and-hold strategy. This “set it and forget it” mindset is most popular when it comes to retirement accounts (i.e. 401(k) plans, 403(b) plans, IRAs, etc.).

Investing in a broad market index, such as the S&P 500, and holding it for many years (whether the market is up or down) would constitute as passive, long-term investing. In direct contrast, active investors share the sentiment that there are inefficiencies in the market, and that it is possible to take advantage of short-term price fluctuations to add alpha within their portfolios.

This investment strategy is most associated with professional portfolio managers alongside their team of investment analysts. They use technical analysis to determine potential opportunities in the market. Active investors attempt to buy low and sell high on a consistent basis to capture the delta between the higher and lower security prices.

While this may lead to outperformance in the short run, the magnitude of the impact that losses can have on a portfolio combined with the tax-inefficiencies of active trading creates a unique hurdle compared to passive investing.

Is the Risk Worth the Reward?

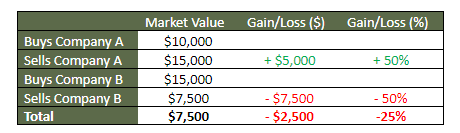

From a wealth management services point of view, let’s first discuss the heightened impact that losses can have on a portfolio driven by active investing. Bob is an active investor that loves to trade stocks in his free time. He starts out with $10,000 and invests it in Company A.

A few months later, Company A’s share price gains 50%! Feeling happy with his return, Bob sells his position in Company A and decides to reinvest his proceeds into Company B. In just three weeks, Company B misses on its earnings for the quarter and the share price drops by 50%. Not wanting to lose anymore, Bob sells Company B at a 50% loss.

Notice how even though the gain and loss percentages were the same, the 50% loss actually caused Bob to lose a portion of his principal, as shown below:

Now, let’s take this example even further to show the impact that taxes can have on your actual rate of return—specifically showing the difference between actively investing versus holding your investments long-term (more than one year).

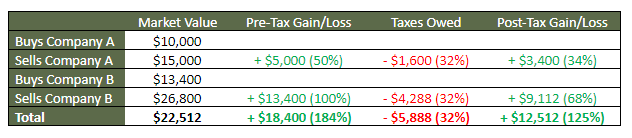

Let’s suppose that Bob is a top-level manager at a department store and earns $250,000 each year. This puts Bob in the 32% ordinary income tax bracket and the 15% long-term capital gains bracket (we will ignore state tax rates for this example).

In this first scenario, Bob held both stocks for less than one year and both sales of stock created taxable short-term capital gains, which will be taxed at Bob’s ordinary income tax rate. That said, let’s see the tax impact on Bob’s overall return if he were to actually make a profit from both investments.

In this scenario, the stock price of Company A still gains 50% and Bob sells his total position in the company stock. Then, he reinvests his money into Company B. Instead of missing on earnings estimates, Company B has an amazing quarter and the share price doubles.

As you can see in the table above, when Bob sells his position in Company A, he is taxed at ordinary income tax rates and hypothetically has less money to reinvest into Company B. After selling Company B, Bob walks away with a 125% return.

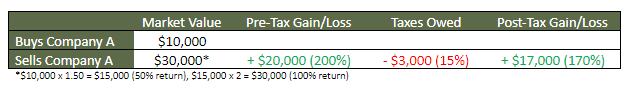

The next scenario assumes that Bob holds onto Company A for longer than one year. Company A has the original 50% gain, and then the share price doubles during the next 12 months after releasing a new product (the same performance assumptions in the prior scenario: 50% + 100%).

What a difference in returns (125% to 170%)! Bob was able to keep his money invested in Company A to qualify for long-term capital gains rates, which also allowed all of his dollars to continue to work for him throughout the entire period.

While we do not let tax planning drive our investment decisions as retirement planning advisors, this example demonstrates the tax benefit of holding your investments long-term rather than actively trading short-term.

Planning is Key

Tax planning can make a big difference in the after-tax returns of your portfolio. While in some instances active investing may outperform the index, it is important to consider how transaction fees, taxes, and market-timing impacts your net returns.

If you have any questions about active or passive investing, or if you would like to speak with a CERTIFIED FINANCIAL PLANNER™ professional, please give Tull Financial Group a call at (757) 436-1122 to discuss your specific situation.

We would be happy to set up an appointment with you, virtually or in-person at our Chesapeake, Virginia office, to discuss how our financial planning services can help you reach your financial goals.