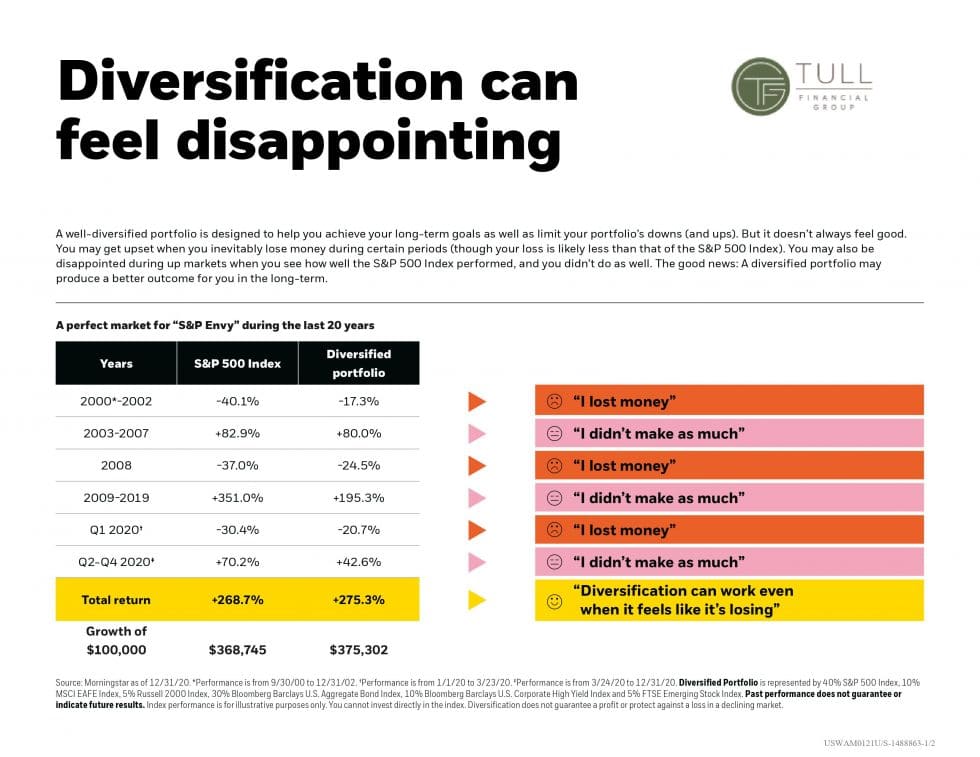

As a portfolio owner, one of the most important investing lessons is diversification. A retirement financial advisor will tell you that a well-diversified portfolio can help you achieve your long-term goals and may limit your portfolio’s volatility (ups and downs) compared to a portfolio representing a single asset class (like a fund or ETF designed to track the S&P 500 Index).

Start With an Investment Plan

Having an investment plan can be just as important as planning out your flight path and knowing your destination before you take off.

Financial planning services can help you craft your investment plan by answering these questions:

- What is your goal? For example, is it to accumulate $1 million in retirement savings in 40 years? Do you simply want to earn a reasonable return on your existing portfolio, net of inflation, while minimizing exposure to stock market fluctuations? Maybe you are saving up for your child’s education and want to pay for four years of college expenses in ten years. Goals can be shorter-term, too—like funding a $30,000 car purchase in five years. Whatever your goal is, it helps to clearly define it when considering your asset allocation plan.

- How much risk are you comfortable taking? One way to think about this is considering how much you could stand to lose on your portfolio in a six- or twelve-month period.

- How much will you invest each month or year? Will this amount increase? As you get closer to retirement or enter retirement the question changes to, “How much will you need to draw from the portfolio each month or year? Will this amount increase?”

- What other limitations do you need to keep in mind? Do you have a hard deadline? A concern about taxes? A small initial investment? A strong view on inflation or the economy? Restrictions related to your employer’s policies? A poor experience with a particular asset class in the past that results in a strong aversion to investing in it again?

Your Asset Allocation Plan & Diversification

Your investment plan will drive your asset allocation plan which helps build your portfolio in the right mix of asset types. A diversified mix of asset types will give you more control over how risky your portfolio is.

It is important to note that no investment is without risk, and there is no “right” or “wrong” allocation plan. There is just the asset allocation plan that is right for you and your unique situation.

Starting with the big picture, consider asset types such as equities (for growth), bonds (for income and capital preservation), and cash (for liquidity needs in the next two years.)

For example, an asset allocation plan for an investor just starting who does not expect to pull from their investment funds for more than 10 years and has a high tolerance for risk may just be 100% equities.

As time goes on, that investor may choose to reduce the percentage of equities and add to bonds and/or cash as they near retirement or have specific liquidity needs.

Diversify Within Your Asset Allocation Plan

A retirement financial advisor may advise you to start with a broad-based index fund to diversify among sectors and reduce single-stock or sector risk.

A broad-based index fund like the S&P 500 Index will give you extensive exposure to all sectors of the U.S. stock market by investing in 500 companies versus a handful of stocks that can be tricky to predict performance.

Next, consider complementing your fund with a few different funds of varying risk levels to diversify your risk.

- Purchase small-cap companies. Small-cap companies are historically higher risk than large-cap companies, meaning they experience more volatility. However, they can outperform large-cap companies over time and particular periods.

- Purchase non-U.S. companies. Two-thirds of companies are overseas, including developed international and emerging market countries. Non-U.S. equity returns tend to benefit from periods where the dollar is falling. Having allocations to them tends to offset any losses or lags in the performance of U.S. stocks.

- Purchase ETFs that track the price of real assets. Some investors like to invest in real assets like gold, commodities, precious metals, and real estate. It is important to define why you want to hold these as they can be extremely volatile and thus not appropriate for every investor—despite promises of great returns. Also, it is worth noting that if you own a house and/or jewelry you already have some exposure to these asset classes.

- Diversify within bonds. A broad index for bonds is the Bloomberg Barclays U.S. Aggregate Bond Index. As your portfolio grows you may wish to complement this by buying high yield bonds for income (non-investment grade/lower credit quality but higher yielding), non-U.S. bonds (which may benefit from the same currency effects as non-U.S. stocks), and other bond sectors.

Stay the Course

Without a crystal ball, it can be difficult to determine when one asset class will outperform or underperform. It is wise to stay diversified and stay the course to smooth out the ride over time. Tune out the noise of which asset class is outperforming at the moment and remember that the tides will turn at some point.

If you’re looking for a trusted partner in financial planning services to help you diversify your portfolio and reach your financial goals, Tull Financial Group is here to help. Give us a call on 757-436-1122 to set up an in-person or virtual consultation today.